eToro OpenBook Platform

Introduction to eToro’s OpenBook

eToro OpenBook is a social trading network that allows users to trade global markets by copying the trades of others. The OpenBook platform is available exclusively to eToro clients. According to the company, it currently has millions of active members. The platform is designed with simplicity in mind, making it accessible to all types of traders, including Forex beginners.

eToro OpenBook Features

eToro OpenBook Features

Traders using the eToro OpenBook can connect in real-time with hundreds of signal providers. The platform allows users to track and monitor top traders, as well as follow and copy their trades. In return, other users can follow and copy your trading activity. Sharing your trades is optional and can be disabled at any time.

eToro Signal Providers

◘ A demo OpenBook account is available (limited functionality)

◘ Free CopyTrader feature

◘ Copy up to 20 traders at any time (one-click copy trades)

◘ Minimum copy trade position: $50

◘ Personal trading watchlist and Top-100 traders (filtered by individual criteria)

◘ Communicate with and seek advice from copied traders

◘ Post social comments on specific trades and share them publicly

The CopyTrader Feature

CopyTrader allows members to see what top traders (“gurus”) are trading in real-time. It then enables any member to follow them instantly with just one click. The trading activity is copied proportionally into the follower’s account. The CopyTrader feature involves three basic steps:

-

Track the best traders based on your trading style

-

Copy them with a single click

-

Adjust the investment amount and trade

New Traders and the eToro OpenBook

Every new trader who signs up with eToro automatically gains full access to the platform’s copy trading features. Each member’s trading activity is analyzed and published by the system. OpenBook provides insights such as Risk/Reward Ratio, Traded Instruments, and the Average Duration of Each Trade. You can stop copying any trader at any time by simply selecting them in the CopyTrader interface.

Advice

New traders should exercise caution when following trading signals from others. Rankings can be subjective, and the performance shown is based on historical data. Some top-ranked traders may have used extremely risky strategies in the past.

How the System Evaluates Each Trader’s Performance

Trader performance is evaluated based on either daily or cumulative win percentages, factoring in the total number of trades and the win/loss ratio. Performance data is updated in real-time. The OpenBook platform uses multiple filters to rank traders, with key criteria including:

a) Minimum total investment during a specified period

b) Minimum number of transactions over a given time frame

c) Minimum win ratio during a specific period

d) Minimum number of active weeks (with at least one closed trade per period)

e) Maximum leverage ratio used

f) Maximum leverage applied in individual trades

Keep in mind that the OpenBook ranking algorithm is frequently updated.

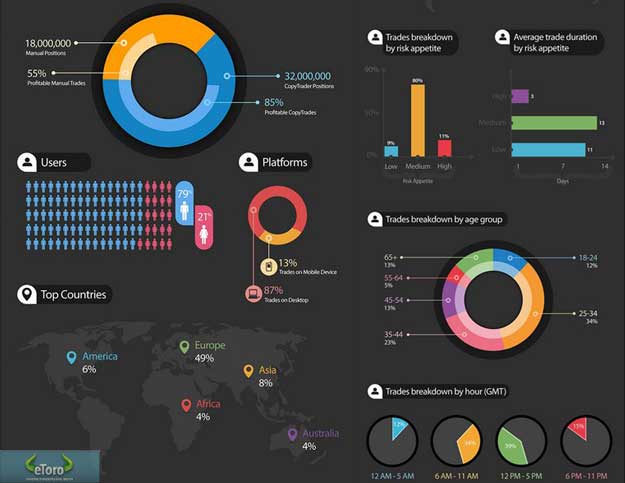

Statistics for eToro OpenBook

Graph: eToro OpenBook Statistics

Who is eToro?

eToro is a well-known Market Maker Forex broker, founded in 2006. It is regulated by ASIC (Australia) and CySEC (Cyprus). eToro USA is a separate entity within the same group and is regulated by the NFA and CFTC.

eToro’s spreads are typical for a Market Maker broker, and no trading commissions are charged. The lowest spread is on USD/JPY at 2 pips, while EUR/USD is offered at 3 pips. Maximum trading leverage is 400:1. Note that scalping and hedging are not allowed.

eToro’s Trading-Forex Spreads

As shown in the table below, eToro’s spreads are relatively high compared to the competition, making intraday trading and scalping strategies difficult to implement.

|

Symbol |

Forex Pair |

Spread Charged |

|

USD/JPY |

US Dollar/Japanese Yen |

2 Pips |

|

NZD/USD |

New Zealand dollar/US Dollar |

3 Pips |

|

USD/CAD |

US Dollar/Canadian Dollar |

3 Pips |

|

USD/CHF |

US Dollar/Swiss Franc |

3 Pips |

|

AUD/USD |

Australian Dollar/US Dollar |

3 Pips |

|

EUR/USD |

Euro/US Dollar |

3 Pips |

|

GBP/USD |

British Pound/US Dollar |

4 Pips |

|

EUR/GBP |

Euro/British Pound |

4 Pips |

|

EUR/JPY |

Euro/Japanese Yen |

4 Pips |

|

EUR/CHF |

Euro/Swiss Franc |

5 Pips |

|

GBP/JPY |

British Pound/Japanese Yen |

6 Pips |

|

AUD/JPY |

Australian Dollar/Japanese Yen |

7 Pips |

|

EUR/AUD |

Euro/Australian Dollar |

8 Pips |

|

CAD/JPY |

Canadian Dollar/Japanese Yen |

8 Pips |

|

CHF/JPY |

Swiss Franc/Japanese Yen |

8 Pips |

|

EUR/CAD |

Euro/Canadian Dollar |

9 Pips |

■ eToro OpenBook Platform Review

Forex Automatic (c)

![]() READ MORE ON FOREX AUTOMATIC

READ MORE ON FOREX AUTOMATIC

• COMPARE

□ Trade Platforms

□ Expert Advisors

□ Signal Providers

□ Forex Brokers

• REVIEWS

► MetaTrader 4

► MetaTrader-5

► cTrader

► NinJaTrader

► JForex

► StrategyQuant

► MirrorTrader