Social, Mirror, and Copy Trading

Social trading is the future of online trading. Instead of monitoring and analyzing thousands of financial markets yourself, you can select the right provider to do that for you. This offers significant benefits in terms of time savings and streamlining the entire trading process. Social trading essentially involves collecting financial information and making trades based on that data. Copy trading and mirror trading are two automated social trading methods that involve automatically replicating the positions of other traders.

(A) Social Trading → Gathering Social Info → Manual Trading

(B) Copy trading & Mirror Trading → Automated Trading

More: » Compare Robots | » Compare Fx Systems | » Compare Platforms

Social Trading Platforms

There are dozens of social trading platforms available, each offering different copy trading features. Key points of differentiation include:

-

Number of available financial instruments

-

Number of available copy providers

-

Management fees (if any)

-

Cost per trade / commission structure

-

Average spreads

-

Minimum and maximum copy trading amounts

-

Ability to set a maximum allocation of funds

-

Advanced risk control (e.g., the ability to place a stop loss on the entire copy-trading relationship)

-

Ability to monitor and manage each copied position

-

Access to the full trade history of the signaling service (or copy provider)

-

Availability of a demo account

-

Variety of accepted funding methods and currencies

-

Customer support options (including supported languages)

-

Regulatory status and client account segregation

These are some popular social trading platforms:

(1) Dukascopy Social Trading Community

Dukascopy is a Swiss-based Forex bank that provides social trading through the Dukascopy Community and the JForex automated platform. The Dukascopy Group offers two account types:

Dukascopy is a Swiss-based Forex bank that provides social trading through the Dukascopy Community and the JForex automated platform. The Dukascopy Group offers two account types:

■ Dukascopy Bank (minimum account $5,000, only bank wire)

■ Dukascopy Europe (minimum account $100, bank wire and credit cards)

The Dukascopy Community is built in the Dukascopy website and offers full social trading features, including:

(1) Discussions & Market Analysis

(2) Social Trading Contests

(3) Full Copy Trading Features

(4) Live-Chat Support

Dukascopy Social-Trading Advantages:

-The spreads start as low as 0.25 pip plus $4.8 trading commissions per full traded lot

-There are no subscription fees

-There are no additional volume commissions

-The copied positions are opened automatically even when you are offline.

-Set-up a general Stop-loss level on your account

-Set-up a trading ratio for each copy provider

-Manage your copied positions via JForex or JForex mobile (alter or close any copied trade)

-Get 30% off all commissions paid for the 1st month (rebate link only that follows)

-Full client's account segregation

-Demo Account: Yes

Dukascopy Accounts:

■ Account Currencies: Euro | US Dollar | British Pound | Australian Dollar | Canadian Dollar | Hong Kong Dollar | Japanese Yen | Swiss Franc

■ Minimum Deposit: 100 USD

■ Funding Methods: Bank Wire, Maestro, Visa, and Electron

Rebate Link: You can enjoy also a 30% commission rebate for your first month of trading (works both with Dukascopy Bank and Dukascopy Europe):

(2) OpenBook Platform (eToro)

eToro is a highly popular social trading platform, known for its wide variety of copy providers and user-friendly interface. However, eToro operates as a Market Maker (Dealing Desk broker) and is associated with relatively high trading costs. For example, the EUR/USD spread is 3.0 pips.

More about eToro OpenBook: ► eToro OpenBook

-No US Clients

-Demo Account

-Minimum Deposit: $50

-Maximum Leverage: 400:1

-Expensive Trading

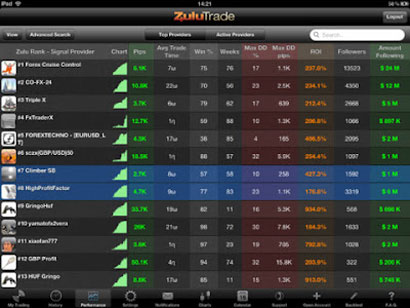

(3) ZuluTrade

ZuluTrade is a well-known social trading platform supported by over 50 Forex brokers worldwide. It offers comprehensive copy-trading functionalities, including binary options copy-trading. ZuluTrade is affiliated with the ECN Forex broker AAAFX, which also accepts traders from the U.S.

ZuluTrade is a well-known social trading platform supported by over 50 Forex brokers worldwide. It offers comprehensive copy-trading functionalities, including binary options copy-trading. ZuluTrade is affiliated with the ECN Forex broker AAAFX, which also accepts traders from the U.S.

-

Instruments: Currencies, commodities, and equities

-

Maximum leverage: 1:200

-

Minimum opening deposit: Depends on the broker; AAAFX requires a minimum deposit of $300

-

Fees: ZuluTrade’s service is free, though brokers may charge a commission for using the copy service

-

Demo account: Available

-

Signal providers: Not required to trade with their own funds

-

Money management tools: Advanced

-

Performance analytics: Extensive

-

Mobile apps: Yes

-

U.S. traders: Accepted

The ZuluTrade Automator feature allows traders to define custom settings and rules—for example, locking in profits or manually updating Stop/Limit levels for each trade.

(4) Tradeo

The Tradeo social trading platform offers access to market news and trading sentiment, along with features for interaction and messaging between traders. Tradeo operates as an STP (Straight Through Processing) broker.

-

Instruments: Over 100 Forex and CFD instruments

-

Broker model: STP

-

Leverage: Up to 1:200

-

Platform: MetaTrader 4

-

Account currencies: USD, EUR, GBP, and JPY

-

Minimum deposit: $100

(5) Ayondo (Ayondo Markets)

Ayondo is a Europe-based social trading network that also operates as a broker.

-

Demo account: Available

-

Copy provider selection: Limited

-

Commission model: Based on performance (percentage of gains)

-

Funding methods: Bank wire, credit cards

-

Account currencies: Euro, US Dollar, British Pound

-

Minimum account deposit: 100 USD / EUR

-

Regulation: FCA (License No. 184333)

(6) Tradency Mirror Trader (Several Brokers)

The Tradency MirrorTrader platform is widely used by brokers around the world. It allows users to copy trades from any customer of these brokers, providing access to a broad range of strategy providers regardless of the broker selected. While the platform supports automated and copy trading features, it does not include social interaction functionalities.

-

Signal generation: Most signals are generated by trading robots and copied in real time

-

Trading modes: Fully automated, semi-automated, and manual options available

-

Copying model: Trades can be copied proportionally

-

Tools: Strategy filters and performance monitoring

-

Social features: No interaction between traders

More about the ► Mirror Trader

Basic Terms

- Social Trading

Social trading generally refers to gathering information from various financial sources to support trading decisions. It provides indicators derived from the data feeds of other traders, which can be highly valuable. In addition, traders can observe the live trading activity of others, interact with them, and even manually copy their trades. For those who prefer to automate their trading process and save time, there are two automatic methods of replicating the trading activity of others: Copy Trading and Mirror Trading.

- Mirror Trading

Mirror trading allows traders to automatically “mirror” the trades executed by selected signal services. It differs from copy trading in how the client account is linked to the signaling service. Mirror trading supports the use of multiple automated trading services, enabling diversification of trading activity. However, it requires close monitoring to ensure there are sufficient funds to support the trading strategies being followed. In summary, mirror trading is best suited for larger traders who execute high volumes and are willing to actively monitor their account activity and balance.

- Copy Trading

Copy trading is a similar method to mirror trading, enabling the automatic replication of trade positions. These positions are opened, managed, and monitored by selected providers who are also active traders. The ability to copy trades is typically offered through a social trading network.

Copy trading allows users to allocate a portion of their funds to the account of the chosen investor. Any position opened by the copied investor is simultaneously opened in the user’s account, in proportion to the selected allocation. Traders usually have the ability to monitor, modify, or close copied positions, and can terminate the copy relationship either partially or entirely at any time.

■ Social Trading Platforms, Copy Trading, and Mirror Trading

ForexAutomatic.com

![]() READ MORE ON FOREX AUTOMATIC

READ MORE ON FOREX AUTOMATIC

• COMPARE

□ Trade Platforms

□ Expert Advisors

□ Signal Providers

□ Forex Brokers

• REVIEWS

► MetaTrader 4

► MetaTrader-5

► cTrader

► NinJaTrader

► JForex

► StrategyQuant

► MirrorTrader